The War for Cash

NICK HUBBLE

Dear Reader

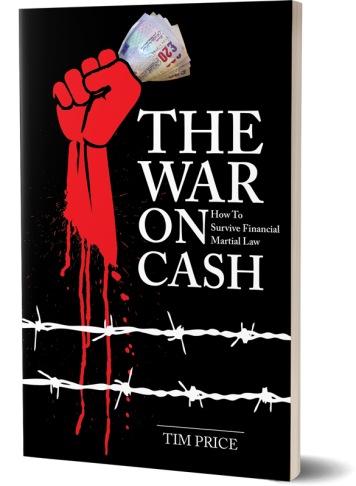

You’ve read about the War on Cash here in Capital & Conflict for years now. Not to mention in Tim Price’s book of the same name, which you should have a copy of by now. It explains “How to survive financial martial law”.

The idea has sprouted all sorts of variations and books around the world. Today I give you my own version of the phenomenon. In typical fashion for me, it’s precisely the opposite of everyone else’s view.

I think the world is in for a War for Cash, not a War on Cash. We’ll see a cash grab, not the abolition of paper money. It’ll be a mad rush for cold hard currency – the physical kind.

You may be interested in

FREE FINANCIAL SURVIVAL BOOK!

How to protect your wealth from Financial Martial Law!

Claim your FREE copy of this popular book by award-winning wealth manager Tim Price now. Find out:

- Why the cash in your savings account could be under threat

- How the authorities plan to seize your private wealth

- How you can take immediate steps to defend your hard earned money!

Discover how to claim your FREE copy!

Capital at risk. A regulated product issued by Southbank Investment Research Ltd. |

In the age of digitalisation, electronic payments using only someone’s phone number, and cryptocurrencies, this sounds a little odd. The thing is, we live in a real, tangible world. For now, anyway. And that means there’s a gap between your life and the digital payments system. One that can widen into a chasm without any warning. Except the one you’re reading now.

Many years ago, I moved to the city of Melbourne in Australia for my first real job. (Flying trapeze gigs are more of a hobby.) To secure a flat, I had to come up with a bank cheque to pay the deposit. But my bank refused to give me one because my bank account was with its stockbroker division. The stockbroker account had all the benefits of a bank account for free and with higher interest. All the benefits except allowing bank cheques, that is.

If it hadn’t been for a large wad of cash from an unexpected source, whom you all happen to know but shall remain unnamed, I would’ve missed out on the flat. Cash saved me when the digital banking system failed me.

Then came the great Australian bank failures. You probably haven’t heard of them before. One after the other over a course of months, Australian banks had tech glitches that led to their ATM cash machines going down. People couldn’t get money for a few hours each time. It caused quite a mess, especially for elderly people without updated payment cards.

This happened in a country that’s very advanced when it comes to digital banking. And that was precisely the problem. An overreliance on digital payment systems working.

Speaking of which, in India, the turmoil caused by going cashless was all over the newspapers. Vox summarised the mess:

| One study, from the All India Manufacturers' Organization, found that micro and small-scale industries showed a whopping 35 percent job loss and a 50 percent decline in revenue in just the first 34 days since the policy went into effect, and that those numbers are likely to continue to increase in coming months. Earlier this month, the International Monetary Fund said that Modi’s policy had caused India to lose its title as the world’s fastest-growing economy, after shaving a percentage point off its projection for India’s growth in 2016. Many of India’s small businesses that handle all their transactions in cash have facing crippling blows to their business.

| |

The New York Times looked into the personal effect this had on lives:

| Many of them, even children, are forced to go without fruit, vegetables and milk — now unaffordable luxuries. Most had not paid apartment rents and their children’s school fees in the months since the cash ban. Many had sent their families back to their villages, and were ready to give up and follow if things did not turn around soon. Sending cash to the elderly parents they had long supported is now out of the question.

| |

But it’s not just India that experienced cash-related turmoil en masse. Reuters reported on how the Federal Reserve shipped huge amounts of cash from its New York depot to Puerto Rico after Hurricane Maria. The banking system there was completely down. Bloomberg claims the Fed even sent a planeload with an “undisclosed amount”.

Tourists were particularly unprepared for the cash crunch, explained Reuters:

| “I‘m out of options,” said Brandon Alexander Jones, a vacationer from London who on Tuesday was down to $85, with no way to get more cash, and no way to reach a friend on the island due to crippled cellular service.”

| |

Imagine if the hurricane had happened in a city where people hold barely any money in cash. Many young people don’t carry a wallet anymore. Just a bank card in their phone case.

Then there was the Greek bank holiday and the empty ATMs during the European sovereign debt crisis. Greek students told me stories about how their families dealt with the lack of cash in the economy. Let’s just say that your surname means more than the size of your bank account when you can’t get at the money.

Being unable to pay because of a lack of cash, even though you have plenty of money, is a bizarre nightmare. But it’s not rare.

These examples show how, when it comes down to it, the digital payment infrastructure is designed to be a more convenient way to business, not a reliable one. When things go wrong, cash is literally flown to trouble spots by the planeload. Cash is still king.

Why? In the end, physical cash is the most basic asset around. Gold can be traded, but not spent. Digital money can be moved and stored far more conveniently, but it needs infrastructure to work. Cash needs just you and the seller, nothing else.

Cash in world of financial fragility

The power of a cash drain is also exposed by what it can do to banks. Bank runs remain a real thing, even if banks are entirely digital. The first recommendation Catalan separatists urged their supporters to do was withdraw cash from Spanish banks to apply pressure to the government.

For financial infrastructure to function, an alarming amount of things must run smoothly. Power, bank systems, payment systems, communications systems, financial markets, governments and more. In a crisis, rolling failures in these are likely. Not to mention government-mandated shutdowns.

Convenience and cost are huge gains from digitisation. But what are the costs? Robustness? Surveillance? A false sense of confidence?

What’s clear is that, in any crisis, there’s a war for cash. Being among those who are cashed up in these situations can be an extraordinary benefit. A widespread shortage of money means prices tumble. The ability of money to make exchange possible makes it immensely valuable during these times.

So what should you do? Boaz Shoshan is working on a set of recommendations about issues like this. Cash is just one thing you need to have in a world of threats – economic and political. His reports should be ready soon.

In the meantime, just wait and see what happens if there’s a major power outage in India and the economy freezes. Suddenly, having cash will become a national security issue.

Bitcoin in the War for Cash

Where does bitcoin stand in the War for Cash? It depends on the crisis you’re expecting.

On the one hand, bitcoin doesn’t require much of the infrastructure that digital money does. Governments, banks and much more can be down or restricted and this will only boost bitcoin. That’s what’s happening in Zimbabwe right now. There’s an 80% premium inside the country if you pay in US dollars. People willing to fly to Zimbabwe with bitcoin and return with suspicious amounts of cash can do so at a whopping arbitrage profit.

On the other hand, bitcoin relies on power and communications systems. And a lot of both. The payment system Square, which lets you plug a little USB dongle-sized device into your phone to accept payments from credit cards, is testing bitcoin on its systems. So the variety of payment systems is increasing, improving robustness. But bitcoin still suffers from many of the same weak points as digital money.

The combination of infrastructure bitcoin requires creates odd situations. For example, electricity is heavily subsidised in Venezuela, creating a bitcoin mining boom there. Chinese people live under capital controls, so they use bitcoin as a transaction method. The Japanese and South Koreans buy bitcoin each time North Korean tensions escalate.

Bitcoin’s future might just be determined by the types of crises we have. Then again, there seems to be a cryptocurrency for everything.

Until next time,

Nick Hubble,

Capital & Conflict |

|

|

No comments:

Post a Comment

Note: only a member of this blog may post a comment.